Table of Content

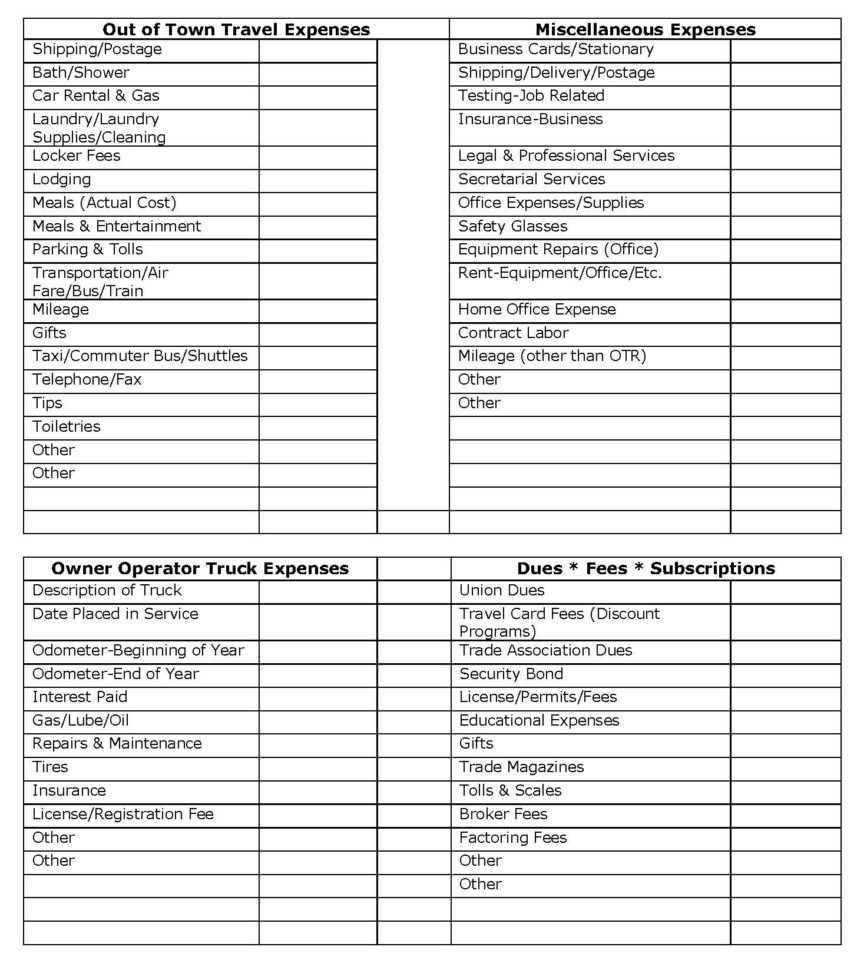

For direct expenses, enter only the amount of expenses allowable for that specific business. These will carry directly to the form and be allowed in full. The IRS doesn't always make it simple to figure out what are personal vs. business expenses when it comes to taxes.

Some examples include the cost of a business telephone line and the cost of painting your home office. However, no deduction is allowed for basic local telephone charges on the first line in your home, even if that line is used for the home office. The same concept relating to direct and indirect expenses applies here. For example, if you buy copy paper for the business or have to repair your home office space. Indirect expenses are once again reimbursed based on a business use percentage. These tasks might include billing customers, keeping books and records, ordering supplies, setting up appointments, or writing reports.

Qualifying for the Home Office Deduction

Under IRS regulations, $18,000 of the capital gain will be tax free. Only the $2,000 of the gain equal to the depreciation deductions will be taxable. First, the business owner no longer uses Schedule C. Instead, the business itself now files Form 1120S. Secondly, the owner of the corporation is considered an employee shareholder. Because of the TCJA, employee business expense deductions are not allowed, so another method to capture home business expenses is needed. The home office deduction allows qualifying taxpayers to deduct certain home expenses on their tax return. With more people working from home than ever before, some taxpayers may be wondering if they can claim a home office deduction when they file their 2020 tax return next year.

Keeping up with these expenses throughout the year instead of trying to calculate them come tax time can save you a lot of time and limit errors. The area must also be your principal place of business and you must use it for business on a regular basis. You run your business from this location, even if you leave to perform certain jobs elsewhere.

Here’s what taxpayers need to know about the home office deduction

Most often, employees working from home bear zero capital gains tax implications for their homes. A home office expense refers to the costs incurred through the performance of business activities within a primary residence. Examples of office expenses may include the internet bill, phone lines, utilities, cost of stationery, taxes, etc. Unless you’re careful, deductions today can cost you money when you sell your home.

The area can’t serve double duty as personal space when you’re not working there. The entire room would meet the qualifying rules if you use a spare bedroom solely and entirely for work. Only a portion of the room would qualify if you also sleep in that bedroom. You can skip all these calculations and use the simplified method for claiming a home office deduction, but your deduction will be limited to $1,500 as of 2022. A selected list of current office spaces from our portfolio for „rent an office“ follows. For more office spaces to rent in Eschborn, click below on „more results“ or contact one of our commercial offices.

Method for Calculating Home Office Expenses

Direct expenses are those that directly impact the office portion of your home. For example, repairing the drywall in your office space or installing carpet. These expenses relate solely to the office portion of your home and are deductible in full. For example, assume you set aside one room in your home as your home office.

The smaller amount between and is the home office expense to be deducted. The total income that the business conducted at a home office can generate. The number of rooms exclusively used for business can be divided by the total number of rooms in the home if the rooms are similar in size. It must be a place where the business owner meets patients, clients, or customers. Depreciation is a complicated deduction with many special rules, so you might want to consult with a tax specialist for more information.

Telecommuters might also qualify for the home office deduction

As with real estate property taxes, be sure not to deduct your mortgage interest twice if you itemize. Mortgage insurance premiums may also be deducted depending on your income. Some indirect expenses are pretty common and are subject to this equation, along with some other factors that can affect the amount you can deduct. Starting in 2013, the IRS offers a Simplified Method for deducting your home office--if your home office is 300 square feet or less. If your home office is more than 300 square feet you must deduct your home office using the Regular Method. You do not have to use the simplified method, but it's pretty slick.

Be sure you use this structure only for business purposes — you can’t store your car there. An Accountability Plan is the method S Corp owners should employ to take a deduction of their home office expenses. Under this structure, the owner would submit a reimbursement request to the business, and the business would reimburse the owner.

The simplified method significantly reduces your record keeping burden, and saves you time come tax season. The simplified option has a rate of $5 a square foot for business use of the home. Deductions from the business use of a home cannot be claimed if these costs are higher than the home office expenses. Your deduction would be $150 for that $1,000 paint job if you had your entire house painted and your home office takes up 15% of your home’s total square footage. There are three types of expenses you may incur while maintaining a home and home office; direct, indirect, and unrelated.

Be careful not to deduct this one twice if you itemize your deductions on your personal tax return. If you deduct a portion of your property taxes as part of your home office deduction, you must reduce the real estate taxes listed on your Schedule A by that amount. If the gross income from your business equals or exceeds your regular business expenses , all expenses for the business use of your home can be deducted. But if your gross income is less than your total business expenses, certain expense deductions for the business use of your home are limited. As you might expect, this test requires you to show that you exclusively use a portion of your home for business purposes on a regular basis.

Enter only the amount of expenses allowable for this business here. Otherwise, the owner should fill out a form listing the type of expense and the amount and put the corresponding receipt with the form and provide the form to the company. Learn accounting fundamentals and how to read financial statements with CFI’s free online accounting classes. The percentage of time may also be necessary for home spaces used for services such as daycare. Find the home’s total area and divide it by the area of the space used for business. Be sure that you only deduct the portion that covers the tax year for which you’re filing.

In addition, though, your home office must be for the convenience of your employer. In plain English, this means that your employer must ask you to work out of your home. The arrangement must serve your employer’s business needs, not vice versa. ProConnect Tax adjusts the amount of indirect mortgage interest and indirect real estate taxes so that only the nonbusiness portion is reported on Schedule A.

No comments:

Post a Comment