Table of Content

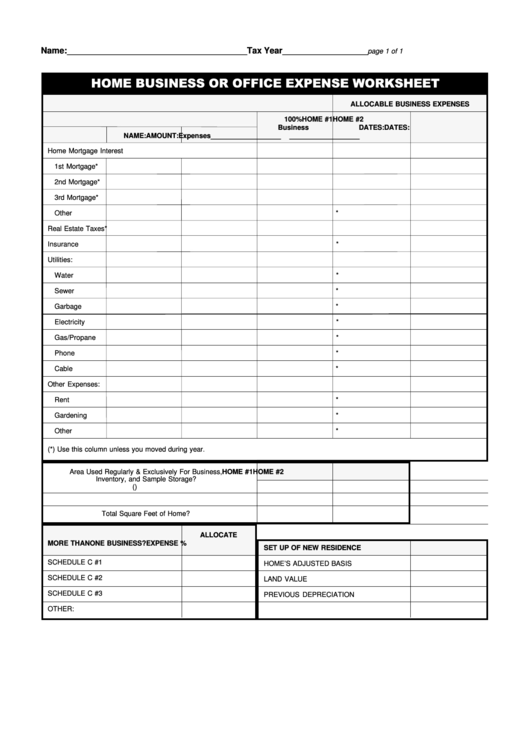

For example, assume you’re a doctor at a local HMO who’s been given examination space but no office space. You use a room in your home regularly and exclusively to correspond with insurance companies, bill patients, and read medical journals. You have no other fixed location for conducting these types of activities. In such a case, your space would likely pass the place of business test for a home office deduction.

Direct expenses are those made specifically to the home office used for business, and not made to the rest of the home. The installation of a ceiling fan in a home office or built-in cabinet in a home office, are both examples of direct expenses incurred for the home office. Taxpayers must meet specific requirements to claim home expenses as a deduction.

Resolve to Keep the Books: 5 Ways Profitable Businesses Stay Organized

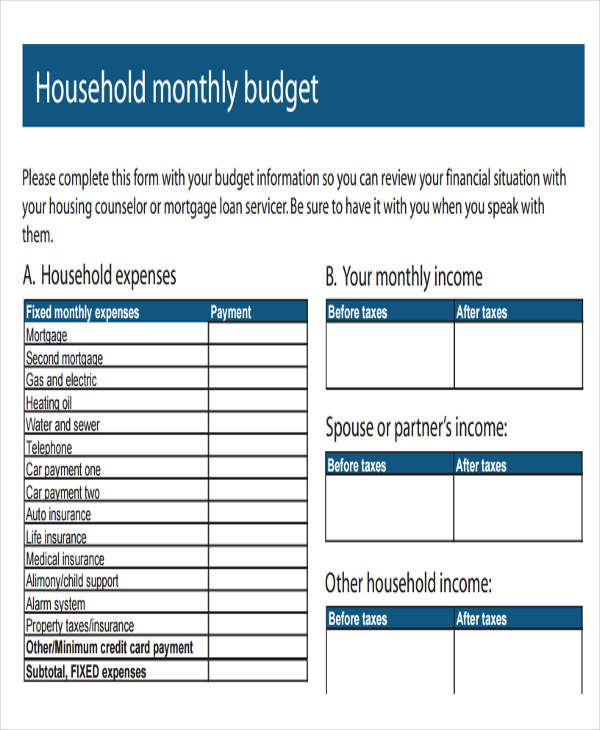

Most often, employees working from home bear zero capital gains tax implications for their homes. A home office expense refers to the costs incurred through the performance of business activities within a primary residence. Examples of office expenses may include the internet bill, phone lines, utilities, cost of stationery, taxes, etc. Unless you’re careful, deductions today can cost you money when you sell your home.

So we're here to give you essentials in a language that you can easily understand. Home office expenses can reduce the tax burden from the annual returns of a business owner who works at home. Direct home office expenses relate to your actual workspace and are fully deductible. The home office deduction for an employee who works at home is taken as a miscellaneous itemized deduction on Schedule A of Federal Form 1040.

Home Office Deduction at a Glance

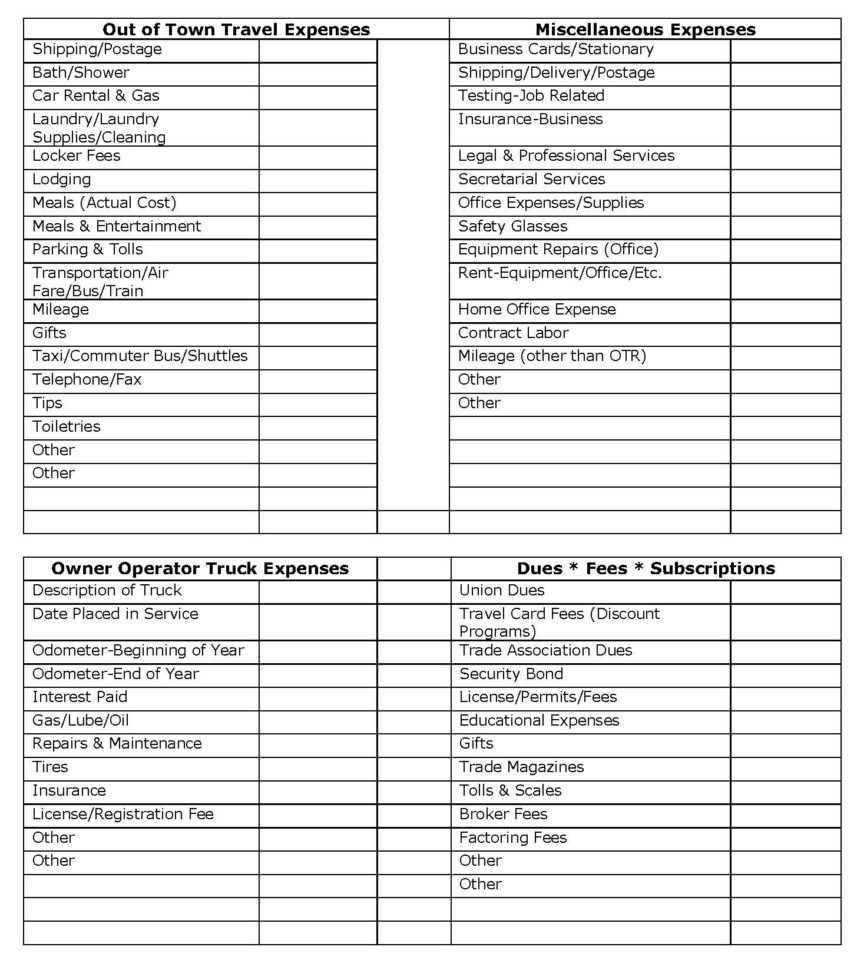

This would be the case with costs like computers, a desk, or office supplies, as well as other expenses such as advertising or legal services. A home office is a room in your home, a portion of a room in your home, or a separate building next to your home that you use exclusively and regularly to conduct business activities. For indirect expenses, enter the full amount of the expense for each home office. For example, if the electric bill is $200, enter $200 for each business occupying the home.

When deducting expenses for a home office, it’s important to differentiate between “direct” and “indirect” expenses. Doesn't include any part of the taxpayer's property used exclusively as a hotel, motel, inn or similar business. For example, in the case of a shared space, they both cannot be deducted. Publication 587 includes additional restrictions of the simplified approach. Unrelated expenses are those that you incur as a homeowner but that do not relate to maintaining a home office.

Understanding Home Office Expenses

Take the purchase price of your home divided by 39 and multiply that by, in this example, 6%. Telephone (if you use a land line, don't include the standard monthly charge. For a home space not used for daycare, find the product of the allowable area and multiply by $5.

This definition is important, because you may be able to deduct part of your housing expenses on your federal income tax return if you have a home office. To take the deduction, you’ll need to file Form 8829 with the IRS. To even consider the home office deduction, though, your at-home business activities must involve a trade or business — a hobby won’t do. Expenses that relate to a separate structure not attached to the home will qualify for a home office deduction.

It’s no secret that you generally can’t deduct certain personal expenses (e.g., homeowners insurance, utilities, and home repairs) on your federal income tax return. But if you’re using part of your home as a home office, you may be able to write off part of these expenses. To qualify for the home office deduction, you must first understand the IRS requirements.

This deduction is subject to the 2 percent limit for miscellaneous itemized deductions. However, as noted, this deduction is not currently available. These are the expenses needed to run the home, and are deductible based on the percentage of your home used for business purposes . Those groceries are not ordinary or necessary for your tailoring business. If you were hosting clients over the weekend rather than family members, then you could totally deduct those expenses. But, it's your family--even though you talk shop with them, it's probably not necessary.

When filling out the direct and indirect columns on the form, put the full amount of the expense . On what is currently line 24, you will take the indirect expense total and multiply it by the percentage of your home used exclusively and regularly for business to figure out the deductible amount. You need to figure out the percentage of your home devoted to your business activities, utilities, repairs, and depreciation. For multiple businesses in one home, make an entry inPercentage (.xx) of indirect expenses and business use area to apply to this business, if not 100%. ProConnect Tax will use this information in conjunction with square footage to allocate indirect expenses between each home office. If you run this business out of your home, you may also be familiar with Form 8829, Expenses for Business Use of Your Home.

This form starts with the square footage of your dedicated home office space. It compares that to your total home square footage to determine the percentage of your home used exclusively and regularly for business or to store inventory. And your home office uses 10% of the total square feet of your, you would allocate 10% of the indirect expenses to your home office deduction. You can multiply the cost of electricity, gas, trash removal, and cleaning services by your percentage of business use. Your telephone wouldn’t be included because the first telephone line to your house is considered to be for personal use.

Direct expenses are those that directly impact the office portion of your home. For example, repairing the drywall in your office space or installing carpet. These expenses relate solely to the office portion of your home and are deductible in full. For example, assume you set aside one room in your home as your home office.

Form 8829 then takes into account both direct and indirect home office expenses. The former category includes things that are 100% deductible, such as a new desk chair. Home office expenses enable self-employed business owners to claim a tax deduction from their annual tax returns for house expenses such as property taxes and mortgage interests. The house expenses can also include additional running costs ranging from an internet subscription to electricity bills.

No comments:

Post a Comment