Table of Content

It's also good to know that some lenders offer personal loans to borrowers with bad credit. If your credit needs work, you may not qualify for the best rates and terms on your loan. But taking the opportunity to improve your credit, shop around with multiple lenders and get prequalified will help you find the best loan to fit your specific needs. If you previously placed a credit freeze on your credit report, you'll need to unfreeze it before requesting prequalification to allow lenders to check your credit.

The lender will then disperse the funds to you, which can take anywhere from a few hours to a few days, and the repayment clock begins ticking. Note that there is an exception if you’re shopping around for a specific type of loan. If your inquiries are all for the same type of loan and are made within a short time span , you won’t be penalized. As you wade through the process of buying a home, youve likely heard the terms prequalification and preapproval commonly thrown around. At first glance, it is easy to assume that these terms refer to the same thing. However, there are some key differences that you should be aware of.

What Is Mortgage Preapproval

So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information. The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site.

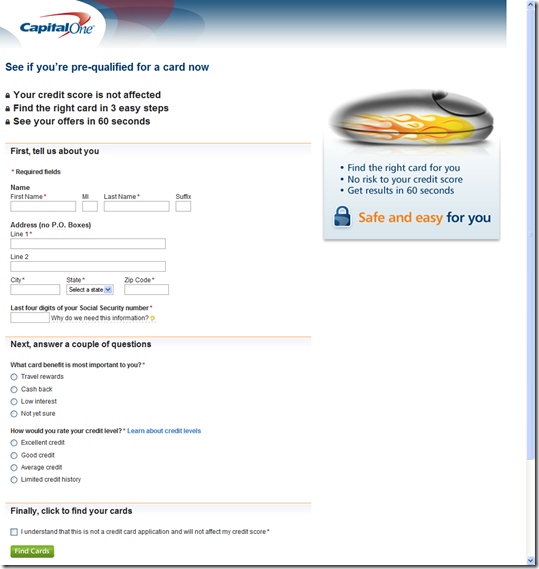

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover. Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. Your loan potential is largely based on two basic financial components. You generally shouldnt expect to pay more than a 30% APR on a collateralized loan unless problems with the collateral make it only marginally acceptable.

Check your credit report

You will find out exactly how much you can borrow from a particular lender, what the terms and rates would be, and so on. The three major credit bureaus consider a prequalification a soft inquiry, which means it won’t hurt your score in any way. Knowing your prequalified rate and loan amount is a crucial first step to house hunting because it ensures you’re looking at homes and making offers within your price range.

If your credit is very low or you’re starting from scratch, consider opening a secured credit card. Secured credit cards require collateral in the form of a monetary deposit, making them an option for borrowers with low or no credit. Using it and paying it off every month could build your credit. When you’re about ready to make an offer on a home, you may want to consider mortgage preapproval, which is a step closer to a loan green light. Preapproval can arm you with the confidence you need to make a competitive offer. Once your financial information is verified, you'll have a clear idea of how much home you can afford.

Need a Loan? Get One in 3 Simple Steps

Trying to prequalify for a car loan is a common process that can help to give you a sneak peek at an auto loan you may qualify for. This step can be a helpful way to set expectations when shopping for a car and eventually applying for your auto loan. Checking your credit score can result in either a soft inquiry or a hard inquiry on your credit.

When you’re ready to get preapproved for a mortgage and want to compare offers from multiple lenders, aim to do it within a 45-day time frame. That’s because in this window, all of the credit inquiries different lenders make appear as one inquiry on your credit report. While your score might be affected by the single inquiry, it won’t be impacted as much as multiple inquiries on your report. Keep in mind that your credit score plays a huge role in whether you can prequalify and ultimately get approved for a loan.

At the very minimum, it's a good idea to check before applying for credit, whether it's a home loan, auto loan, credit card or something else. Loan pre-approval without a hard inquiry is a great option if you are still shopping around for lenders and you do not wish for every loan request to show up on your credit score. This way, you will be able to see your options without any risks—therefore increasing your chances of getting your best loan approved. A prequalification letter is a document that lenders issue outlining how much it’s willing to lend based on a borrower’s self-reported financial information. Prospective homebuyers can use a prequalification letter to demonstrate their financial strength—and the likelihood they’ll be approved for a mortgage—to sellers. For that reason, prequalification letters typically accompany offers to buy property—especially when closing is contingent on the buyer’s ability to secure financing.

Stilt provides loans to international students and working professionals in the U.S. (F-1, OPT, H-1B, O-1, L-1, TN visa holders) at rates lower than any other lender. Stilt is committed to helping immigrants build a better financial future. If your application meets the eligibility criteria, the lender will contact you with regard to your application. Sign and return that note if you wish to accept the loan offer.

Each time you apply for a loan approval, a lender checks your credit with a “hard pull,” which typically lowers your score by a few points. However as stated by FICO®, your credit score generally won’t get hurt if you make all your inquiries on a home loan within a 30 – 45-day period. Shopping around for a mortgage by applying to multiple lenders helps home buyers compare interest rates and fees and choose the deal with the most favorable terms. Finding a mortgage that best fits your financial standing can save you a lot of money over the life of the loan. When you get preapproved, you usually get a preapproval letter. First, real estate agents typically want to see your preapproval letter before they show you houses.

Conventional mortgage lenders generally prefer a back-end DTI ratio of 36% or less, but government-backed loan programs may allow a higher percentage. Getting prequalified for a personal loan also gives you time to review the estimate and make sure you can really afford the monthly payment. Personal loans usually have fixed interest rates, so your payment would be the same each month. This predictability can be helpful, but you need to do the math and ensure the monthly payments would fit into your budget before you commit. Some lenders offer various options, with different terms that change the monthly payment amount.

Personal loans are typically unsecured, meaning they don’t require collateral. This means that personal loan lenders rely heavily on your financial history to determine your eligibility as a borrower. Your credit score is a reliable indicator for lenders, since it factors in your payment history, credit utilization ratio, credit inquiries and other financial information. Prequalifying for a personal loan doesn’t guarantee that you’ll be approved when you put in a formal application. During the formal application process, the lender will conduct a hard credit inquiry, which may reveal financial information that could change your eligibility or the terms you qualify for.

No comments:

Post a Comment